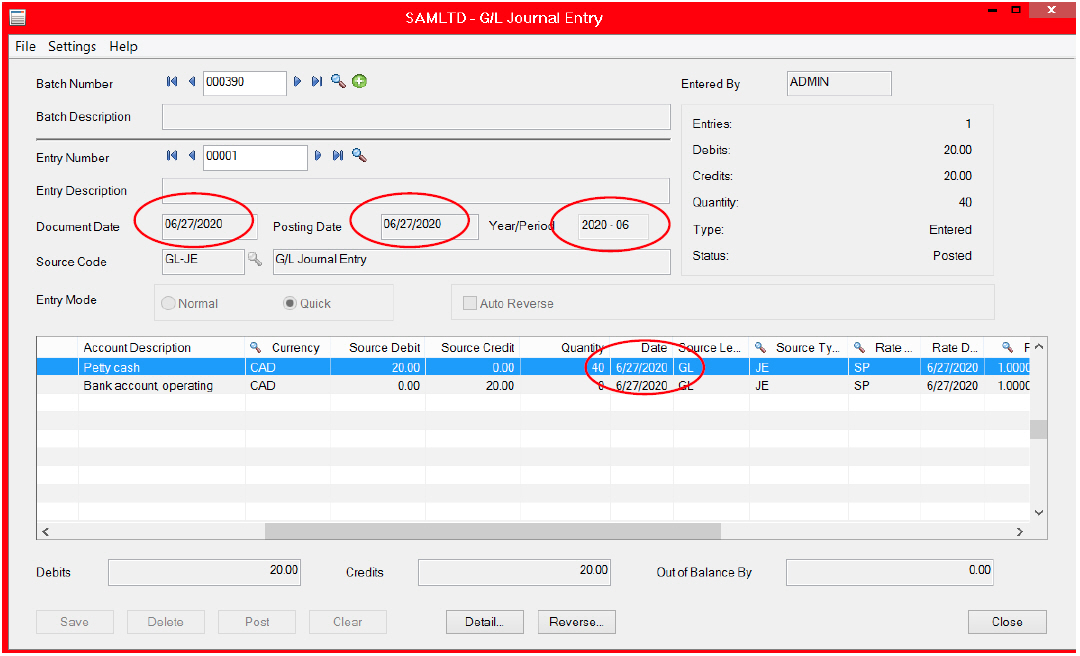

Question: Can you explain the differences between the following three dates in Sage 300 (Under the GL Transaction Screen)?

Answer by William:

I will explain what each date means.

Document Date:

Specify the document date for the journal entry. The complete journal entry has a single document date associated with it.

Notes:

- You cannot change the document date for documents created in subledgers.

- The date assigned to details consolidated during posting is the last date of the fiscal period to which they were posted.

- For GL transactions that were created in Sage 300 2014 or earlier, the posting date is entered in this field by default.

Posting Date:

Specify the posting date for the journal entry. The complete journal entry can have a single date associated with it, or you can enter a different date on each detail line.

The posting date does not determine the period to which the details will be posted. It is for information only. (The period is set by the Year/Period field.)

Notes:

- When you specify a posting date, the corresponding year/period is entered automatically in the Year/Period field. However, changing the year/period does not change the posting date.

- The date assigned to details consolidated during posting is the last date of the fiscal period to which they were posted.

Year / Period:

Specify the year and period to which to post the journal entry.

If you selected the Allow Posting To Previous Years option on the Posting tab of the G/L Options screen, you can post to any existing year for which you maintain fiscal sets and transaction details.

If a fiscal period is closed, you cannot post an entry to that period unless you reopen the period.

Note: You must use the same fiscal period for all details in a single journal entry; that is, you cannot enter two “halves” of an entry to different fiscal periods (causing the ledger to be out of balance in those periods).

Detail Date:

In a journal entry transaction, you can choose to post a transaction to a different fiscal period than what was entered as the transaction date. For example, you could enter June dates in the transaction detail lines, but post the transaction in July.

In a recurring entry, the scheduled run date determines the fiscal period. For example, suppose a recurring entry starts at 06/01/2013 and does not expire. The detail line dates are for 05/31/2013. When the recurring entry is run for 06/01/2013, the fiscal period will be June 2013, and when it is run for 07/01/2013, the fiscal period will be July 2013, and so on.

This date does not determine the period to which a detail will be posted. It is for information only. (The period is set by the Year/Period field.)